In conversation with Paul Niven, Fund Manager, F&C Investment Trust

If you’ve felt as though the markets have been on a bit of a rollercoaster recently, you’re not alone. A mix of shifting economic indicators and global headlines that change the mood overnight have left many investors wondering: What’s the best way to steady the ship?

Paul Niven has a clear answer: “Diversification isn’t just an investing principle—it’s a risk management tool. And in times like these, that matters more than ever.”

This is where F&C Investment Trust comes into its own. As the world’s oldest collective investment fund, with a history dating back to 1868, the . Today, it offers an accessible solution for anyone looking to build a diversified, resilient foundation for their portfolio.

The art of not relying on just one thing

When markets are unpredictable, it can be tempting to pull back, switch lanes, or try to chase the next big trend. But that’s rarely the optimum path to long-term success. Instead, taking time to make sure your investments are spread across a variety of opportunities is usually more effective.

“Our investment process captures a diversified range of listed and private market opportunities,” Paul explains. “By investing across multiple areas, we aim to build a resilient portfolio that can perform well in different market conditions.”

It’s a philosophy that’s helped F&C Investment Trust grow steadily for over 150 years, adapting to change while keeping investors on a path to potential long-term financial success.

Thinking globally

One of the things that sets F&C apart is how global it is. Less than 10% of the Trust’s investments are in the UK because it also looks outward—towards Europe, the U.S., and emerging markets.

“Global diversification is a core part of our strategy,” Paul says. “We reduce exposure to any single economy while capturing opportunities worldwide.”

If one region hits a rough patch, other parts of the portfolio can help keep things balanced. In a world where one country’s policy can ripple across global markets overnight, diversification can help portfolios

Spreading sector risk

Of course, it’s not just about geography. F&C also diversifies by sector—spreading investments across everything from technology to healthcare to consumer staples.

“We construct our portfolio to provide sectoral diversification, ensuring that no single industry dominates our holdings,” Paul explains. “This helps to balance risk and take advantage of different economic cycles.”

If one sector slows down, another may be picking up. That’s the benefit of a broad view: it helps investors who want to avoid putting too many eggs in one basket.

Staying active

F&C doesn’t simply set a course and hope for the best. It’s actively managed, meaning Paul and his team are constantly reviewing what’s happening in the markets and adjusting the portfolio as needed.

“We analyse the economic and market backdrop, taking into account factors such as valuations and investor sentiment,” says Paul. “By actively managing our allocations, we aim to reduce the risk of underperformance while enhancing returns.”

So when the environment changes the trust can change with it, rather than staying locked into yesterday’s strategies.

Opening the door to private equity

For many individual investors, private equity – the world of non-public companies – can seem somewhat out of reach. But F&C includes private equity as part of its diversified mix, offering exposure to this space in a managed, measured way.

“We expect private equity to account for between 5–15% of our assets, adding another layer of diversification,” Paul says.

Private equity can be a source of growth that isn’t directly tied to public market movements. It’s another way F&C seeks to build a resilient and forward-looking portfolio.

Income with a track record

If you’re investing for income, here’s something worth knowing: F&C Investment Trust has increased its dividend every year for more than five decades—54 years, to be exact.

“We’ve delivered over 50 years of consecutive annual increases in dividends,” says Paul. “It reflects our ability to generate reliable income for our investors over the long term.”

There is no guarantee that dividends will continue to increase, but that track record speaks volumes about the Trust’s consistency and focus.

Built to endure

Managing over and sitting in the FTSE 100 index, F&C Investment Trust is one of the most established names in the investment world.

“We remain focused on long-term outcomes and believe our strategy offers the potential to deliver value for shareholders into the future,” Paul says.

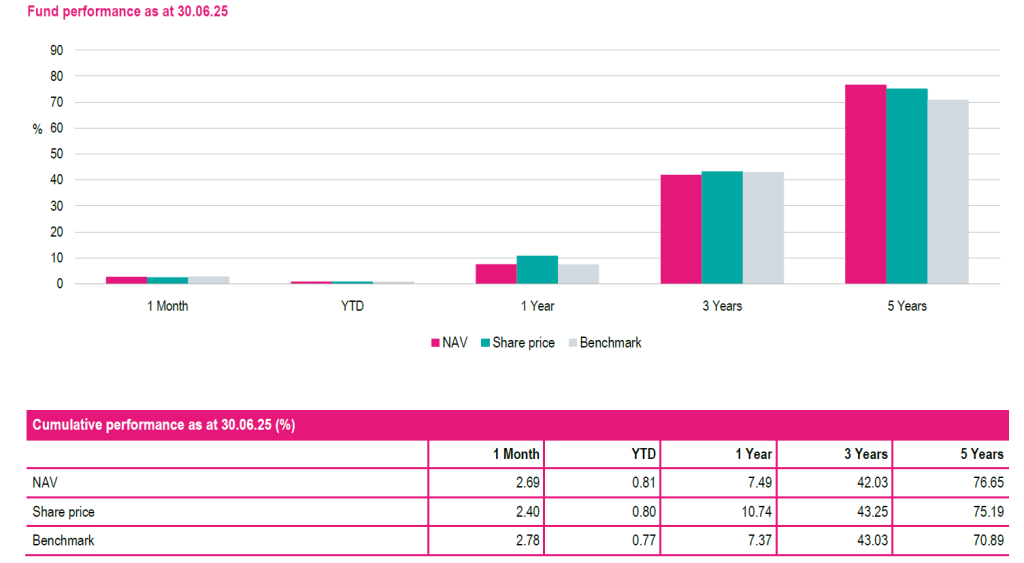

Indeed, the performance of the Trust, as at the end of 2024, showed NAV returns ahead of benchmark over 1, 3, 5, 10 and 20 years while both NAV and shareholder returns exceeded the median return of the peer group over all these time periods. Such consistency of returns is unique amongst closed ended peers. With a team of experts behind it, and a portfolio designed to adapt as the world changes, F&C remains a compelling choice for investors looking for long-term growth and global opportunity.

A smart foundation for our times

If you’ve ever wondered how to make your investments more resilient, diversification could be the answer. And F&C Investment Trust offers a straightforward way to achieve it.

As Paul Niven puts it, “We want our investors to feel confident that their money is working across the world, across industries, and across opportunities. That’s what true diversification offers.”