With the annual report not far away, Jeff Prestridge talks to fund manger Paul Niven about F&C’s performance.

Investment trust F&C publishes its financial results for the year to the end of December 2024 in just over a week’s time – and there are likely to be no major surprises.

The £5.5 billion trust, part of the FTSE 100 index and chaired by Beatrice Hollond, will also be announcing its final dividend for the 2024 financial year.

As a fund committed to delivering long-term income and capital growth, it is 99 per cent certain that the final dividend for 2024 (the fourth quarterly payment) will confirm yet another year of income growth for shareholders.

If so, it will mean 54 years of consecutive increases in the annual dividend. Only four trusts better this: City of London, Bankers, Alliance Witan and Caledonia.

‘We’re in a good space,’ says Paul Niven, one of just three managers to have held the reins of the world’s oldest investment trust since 1969.

The other two are Michael Hart (who died 11 years ago) and Jeremy Tigue, whom Niven took over from in 2014.

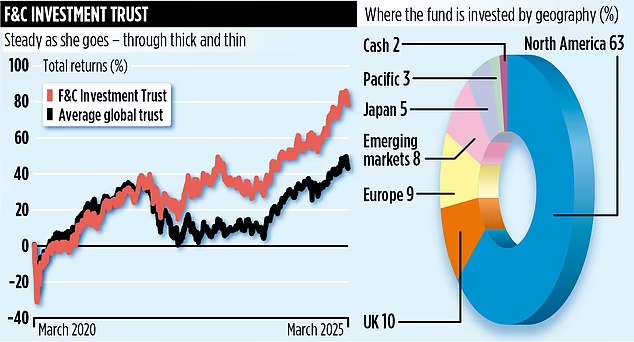

Niven is right to be happy with how the trust is faring. Over the past one, three, five and ten years, it has outperformed the average of its global fund peer group.

And in the process it has generated respective returns of 17.7, 46.7, 78.1 and 198.5 per cent.

More importantly for Niven, the trust has also beaten its benchmark, the FTSE All-World Net Total Return Index over one, three and ten years.

Over these periods, the index recorded returns of 12.6, 36.4 and 186.8 per cent – and 78.6 per cent over five years.

‘We are a solid home for investors who want to grow their wealth,’ he says.

The trust has appealing features besides its cracking performance record.

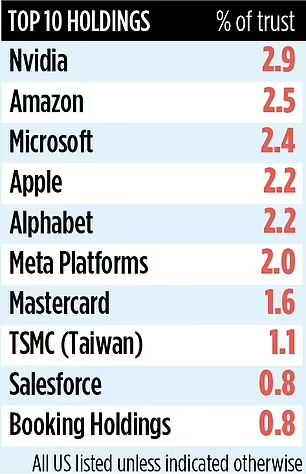

Annual charges are just under 0.5 per cent; it has borrowed £580 million of funds at a dirt-cheap average rate of 2.4 per cent to increase exposure to equity markets; and it’s conservatively run with no individual equity holding representing more than five per cent of assets.

Unlike most fund managers, Niven does not pick the individual stocks that make up the trust’s portfolio, comprising 300 listed equities and 39 unlisted private equity positions.

Instead, he is responsible for determining the fund’s allocation to a variety of investment strategies.

These are run either by Columbia Threadneedle (F&C) – the investment house Niven works for – or third-party managers such as JPMorgan Asset Management, Texas-based Barrow, Hanley, Mewhinney & Strauss, and private equity specialist Pantheon.

‘In the long term, there is more than one way to win as an investor,’ says Niven.

‘Buying cheap shares is one way. Another is buying high-quality companies or growth stocks. We embrace these styles within the trust’s portfolio while ensuring we are not overexposed to specific sectors or stocks.’

Although the trust is heavily exposed to North American equities, and its top six positions are all ‘magnificent seven’ tech stocks, the trust is overall ‘magnificent seven lite’.

Niven says that US valuations look risky although not sufficiently high to trigger a sustained period of underperformance or reversal in the market.

Last week, President Donald Trump’s tariffs, imposed on imports from Mexico and Canada, rattled the US market.

Unlike most rivals, F&C has its own website (fandc.com) and markets its wares on both TV and radio.

‘Investment trusts are a fantastic savings vehicle,’ says Niven. ‘Resilient.’

The trust’s stock market ticker is FCIT and identification code 0346607.

There are no guarantees dividends will continue to increase.

Important information: information is correct as of date of publication. Information from external sources is considered reliable but there is no guarantee as to its accuracy or completeness.