In today’s economic environment, protecting your purchasing power is essential. Even moderate inflation can gradually reduce what your savings can buy over time. Smart investing can help preserve and grow your wealth, helping you stay ahead of rising prices.

Many of us have encountered complicated investment advertisements or struggled to decipher the complex array of investment products available. It’s easy to think we need to do something, but harder to work out what in fact this should be.

Whether you’re taking your first steps into investing or seeking more control over your financial future, we’ve pulled together the following tips to serve as your investment compass. Think of it like your journey to financial empowerment, demystifying the process and equipping you with the knowledge to make informed decisions to meet your goals.

1. The Importance of Diversification

When you are considering investing consider the key building blocks.

There are 5 main types of investment that retail investors tend to think about:

- Cash

- Property

- Gold

- Bonds

- Shares

Cash, property and gold are more obvious. Bonds (not to be confused with ‘premium bonds’) are investments where we lend money to governments or companies in return for some interest along the way. The more risky the country or the company, the higher the interest rate on offer to compensate us for this. Shares – sometimes called ‘equities’ – are literally when we buy a small fraction (or share) of a company.

Generally it’s a good idea to have a mix of the assets listed above because the movements in price can balance each other out.

If, for example, a natural disaster was to occur, shares would typically fall because it is seen as a threat to the normal functioning of companies and markets. No-one’s thinking about buying a new car, flying, or importing steel for their factory when the world is in crisis.

On the other hand, the price of gold could soar. It’s tangible, low risk, you can keep it under the bed – it’s seen as a safe haven when everything else is under threat.

The greatest risk for investors is to have everything on red, and it comes up black. Investing should not be a casino and you shouldn’t risk it all on the spin of a wheel. Putting all your investments into a single company or sector – even if you think it has a great outlook – is to be treated with great caution. There are always risks you cannot anticipate. With this in mind, choosing investments exposed to a wide range of geographies and sectors is an important way of managing risk.

How do you do this? You can minimise the risk of picking one thing which performs badly by picking a ‘fund’ or an ‘investment trust’. These are collections of multiple investments which an expert picks and manages for you – so you are spreading the risk around lots of investments, not just one or two. You’re unlikely to get the highs of picking the one technology stock that goes to the moon, but you reduce the risk of getting the bust. With a diversified spread of investments, if any one of them underperforms or crashes, you can effectively offset the losses against other, better-performing investments in your portfolio.

A good way to start investing is via a global diversified fund. These are designed with simplicity in mind – a sensible choice for those taking their first steps into the investment world. Instead of trying to pick individual stocks or navigate complex market decisions, you can start with a single fund that automatically spreads your money across hundreds companies worldwide. Think of it like having a professional investment team in your corner, making the tough decisions for you.

Starting is straightforward: you can begin with a modest amount and add to your investment regularly, even monthly, much like putting money into a savings account. This approach helps remove the stress of trying to time the market or choose between countless investment options. As markets naturally rise and fall, your money stays diversified across different countries and industries, helping to manage risk while aiming for long-term growth.

Remember: All investments carry risk, and past performance doesn’t guarantee future returns. Consider consulting with a financial advisor to discuss whether global diversified funds align with your personal financial situation and goals.

2. Don’t overcomplicate things

Investing makes us nervous – there is risk involved. And when we get anxious we start to hedge our bets or to endlessly tweak or finesse. Which can actually be counterproductive. If you don’t really get investing, there are options out there a bit like a ready-meal. Where someone else has done all the hard work for you. So you can buy one thing and then largely forget about it, just checking from time to time. Have a look at multi-asset funds, which are a good way to diversify and keep things simple or consider a low-cost global tracker fund, or investigate an investment trust such as F&C, for a ready-made collection of shares. You don’t need to endlessly research and trade and tweak to be a successful investor. In fact you’ll probably be more successful if you don’t.

What is a multi-asset fund?

Let’s break it down. First off, a ‘fund’ can be thought of as a ready-made basket of investments, managed for you by an expert. Funds often come in themes, like collections of shares in sustainable companies, properties in America, or bonds from European governments. Some investors pick and mix about 8–20 funds and make a portfolio.

Not everyone is confident blending this mix of funds. If that’s you, you could consider a multi-asset fund. Imagine a set of Russian dolls – a multi-asset fund is the ‘next doll up’, providing investors with a single product which encompasses a wide range of shares, bonds, property and other types of investment – usually from all over the world.

The idea is to make your investment portfolio as diverse as possible, which helps to spread your bets around. That way, if one of your investments falls flat, only a small portion of your money is affected. It’s less risky than trying to pick winners, requires zero investing knowledge, and takes very little effort as an expert runs it for you. Who said investing had to be difficult?

Is It Right For Me?

Good If You

- Want a balanced investment ready-meal

- Want to invest around the world and in lots of different sectors

- Want someone else to do the research for you

Not Good If You

- Prefer to choose your own shares

- Like to trade the markets

- Don’t want to pay a fund manager’s fee

3. Little and often can be a very smart trick

- Set up an automatic transfer to your investment account

- Schedule it to align with your regular paydays

- Let your investing strategy work over time

In the investing world, we can’t control stock market returns (oh, if only we could!), but we can absolutely control how much fees and charges nibble away at our hard-earned savings. And trust me, those little nibbles can add up to a big bite over time.

The ‘You Get What You Pay For’ Conundrum

This does not mean you should automatically plump for the cheapest option out there. There’s some truth in the old saying ‘you get what you pay for’.

Finding the right investment service is a balancing act. You want a reasonable fee, sure, but you also need a well-governed, reliable home for your money. And let’s not forget about decent tech (because who wants to deal with a website that looks like it’s from the 90s) and good customer service (because there’s nothing worse than being on hold for hours when you need help).

The Three Main Investment Costs

When it comes to investing, there are three main costs to keep an eye on.

- Financial Advice Fees

If you decide to get financial advice (which can be a smart move, especially if you have more complex financial affairs), here’s what you might encounter:

- An upfront fee for initial work: This could be around 3% of your total assets to cover the initial fact find and plan put together by your adviser

- An ongoing fee for advice: expect to pay between half a % and 1% on an annual basis

- Some advisers charge a fixed fee or an hourly rate: this will usually be around £150 – £250 an hour.

- Investment Platform Fees

Next up is the investment platform. Think of this as the department store where you buy, sell, and hold your investments. You will log on to the platform to see and access your investments on an ongoing basis.

Fees here typically range from around 0.25% to 0.45% a year. It might not sound like much, but remember, this is on top of the adviser fees (if you have one) and the investment fees themselves (we’re coming to this.)

- Investment Product Fees

Finally, we have the investments themselves. If you’re buying a fund (which is like buying a pre-packed basket of investments instead of picking them all yourself), costs will typically vary from about 0.25% to 0.85%, depending on what you pick. F&C Investment Trust’s ongoing charge is 0.49% and features as one of the lower cost investment companies (at the time of writing).

It’s like buying pre-made meals instead of cooking from scratch. Sure, it’s more convenient, but you’re paying for someone else to do the work for you.

Note: If you are buying an investment trust, you will pay stamp duty of 0.5% on the purchase and may also pay transaction charges

The ‘Pay More, Get More?’ Question

Now, here’s the tricky bit. Paying more could be fine – but (and this is a big ‘but’), make sure you understand why and what you’re getting. It’s like upgrading to first class on a flight. If you’re getting a lie-flat bed and gourmet meals on a long-haul flight, great! But if you’re paying triple for a slightly wider seat on a one-hour hop, maybe not so great.

The Bottom Line

Remember, every pound you pay in fees is a pound that’s not growing in your investment pot. Over time, even small differences in fees can make a big difference to your overall returns.

So, do your homework. Ask questions. Don’t be afraid to shop around. And always, always make sure you understand what you’re paying for, and think it’s worth it.

Investing involves costs and charges which can vary depending on the product or service chosen. It’s important to consider these when making any investment decision, as they can impact overall returns

5. Use your tax wrappers

Use SIPPs and ISAs to the max

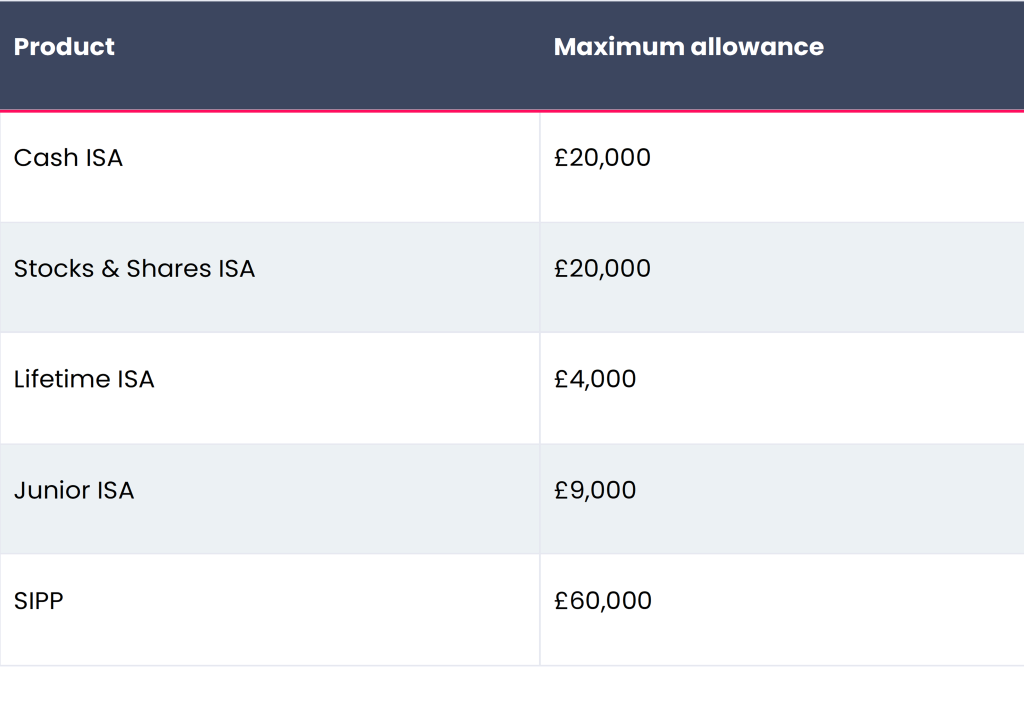

The allowances for SIPPs and ISAs are generous. Most investors can put up to £20,000 a year in an ISA and a maximum of £60,000 a year into a pension. In normal circumstances, you should make sure you’ve used up all these allowances before you think about investing elsewhere. Too many people have cash hanging around in current accounts, not making decent interest and not shielding their money in the tax-efficient ISA or pension.

If you are lucky enough to have used up all your personal allowances, consider those of your spouse and Junior ISAs for children. You will find you can shelter an enormous amount in these basic tax wrappers each year before you have to do anything complicated!

The table below illustrates your personal allowance across different products. (Source: Boring Money, Oct 2024)

Remember: All investments carry risk, and past performance doesn’t guarantee future returns. Consider consulting with a financial advisor to discuss whether global diversified funds align with your personal financial situation and goals.

6. How should I behave once I’ve started to invest?

Investing can make many people nervous. Common questions include: ‘Which investments to choose? How to balance risk? What’s the right level of diversification?’ While diversification helps manage risk, there’s also the challenge of not over-diversifying.

Diversification is a vital way to try to mitigate the risk of any one sector or region performing badly. Many investors look for a good spread of funds to access this broad range of investments.

A common question is ‘How many funds should one hold?’ Some investors, concerned about choosing poorly, may over-diversify with dozens of funds. This can become difficult to manage and may lead to funds working against each other.

Generally, the number of funds someone holds might depend on their investment amount. Those starting with smaller amounts may hold fewer funds, while larger portfolios might warrant more extensive diversification.

Avoiding frequent changes to a portfolio can be beneficial. Reacting to every market downturn or period of underperformance risks chasing past performance rather than future potential.

Consider looking for established funds with broad coverage of regions and sectors. As famous investor George Soros noted, “If you’re enjoying investing, you’re probably not very good at it!”

A balanced approach might include:

- Selecting investments in established companies globally

- Using independent research firms like Morningstar or Trust Net for analysis

- Limiting portfolio adjustments to reduce trading costs

- Reviewing investments periodically, perhaps every 6 months

- Maintaining perspective during global shocks, whether pandemic-related, market volatility, or geopolitical tensions

Taking a long-term approach to market investing can be an important factor in investment decisions.

7. Get Started!

When thinking long-term, there’s rarely a “perfect” time to start investing. Many people delay getting started because they’re waiting for the ideal moment or searching for the optimal investment provider. But trying to time the market precisely or find the absolute best option can lead to costly delays. The golden rule remains: it’s time in the market, not market timing, that typically matters most.

Here are 4 potential ways to bite the bullet and get going.

- All of the robo advisers (automated investment services) on the Boring Money comparison tables have a range of investment collections which can help you get started. These are typically user-friendly options for less confident investors.

- Larger mainstream investment platforms will have own brand ready-made solutions, which will give less confident investors a decent blend of investments and tick that diversification box.

- If you want to pick and choose your own, most investment platforms have filtered fund lists which their research teams rate, and you can double check any funds mentioned on independent research website such as Morningstar and Trust Net.

- Or you could also look at the Association of Investment Companies (AIC’s) website and find those investment trusts which have been going in some cases for over 100 years and have a very solid pedigree.

Many options now let you start with small amounts – this can be as little as £25. So even if you are feeling hesitant, you can still make a start. And gradually build confidence as you go. Just remember not to judge things on the first three months – this is a long-term play which should be for at least 5 years or more, so resist the urge to log on every day and check the ups and downs.

Beginners should remember to keep it simple, stay diversified and be cautious of anything that promises guaranteed, or supersonic returns which sound too good to be true. And finally, there is no perfect time and you’ll never get the timing just right. You just need to take a deep breath and start.

Thank you very much for taking the time to read our investment tips, for more information and educational pieces on investing, please visit the Learning Centre.

Columbia Threadneedle Investments does not give any investment advice. if you are at all unsure whether an investment product referenced on this website will meet your individual needs, please seek advice before proceeding further with such product. LISA eligibility criteria and withdrawal charges may apply.